InsurAI: Your Personalized Insurance Assistant for Customers

InsurAI helps customers select the right product, answer coverage queries, solve support requests and so much more powered with GenAI for Insurance

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

.png?width=2000&name=Isolation_Mode%20(1).png)

Download Products PDF

Trusted by leading global enterprises. Loved by customers.

Appreciated by customers worldwide

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Personalized Responses to product and coverage queries without Intents with GenAI

Personalized Responses to product and coverage queries without Intents with GenAI

Build insurance chatbots from your knowledgebase, PDFs or website data without the need for building or maintaining intents using our AIDA (Artificial Intelligence Digital Assistant) chatbot platform, powered by our patent-pending DocBrain technology. Whenever you have a new insurance product, the chat or voice bot automatically learns by tracking your data, with no need for additional training.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

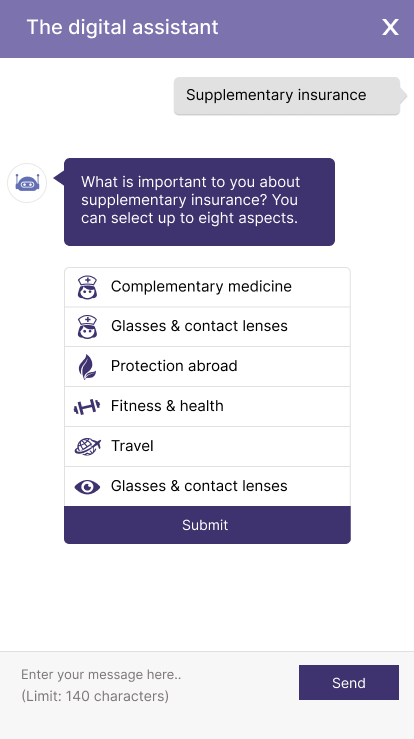

Increase sales and conversion of Insurance products

Increase sales and conversion of Insurance products

Increase leads and sales of insurance products with Enterprise Bot's omni-channel solutions coupled with personalized conversational capabilities and smart recommendation flows that provide users with information and product selection help, while giving organizations valuable insights into customer interests. Our solution has helped our insurance clients capture 23% of the Swiss health insurance market, delivering exceptional CX to their clients.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

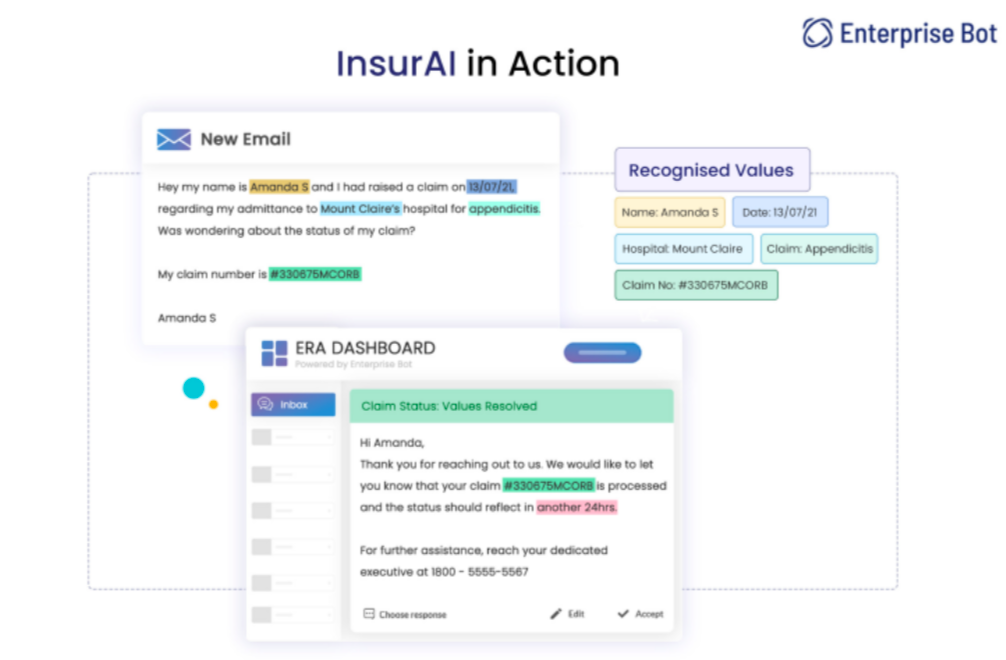

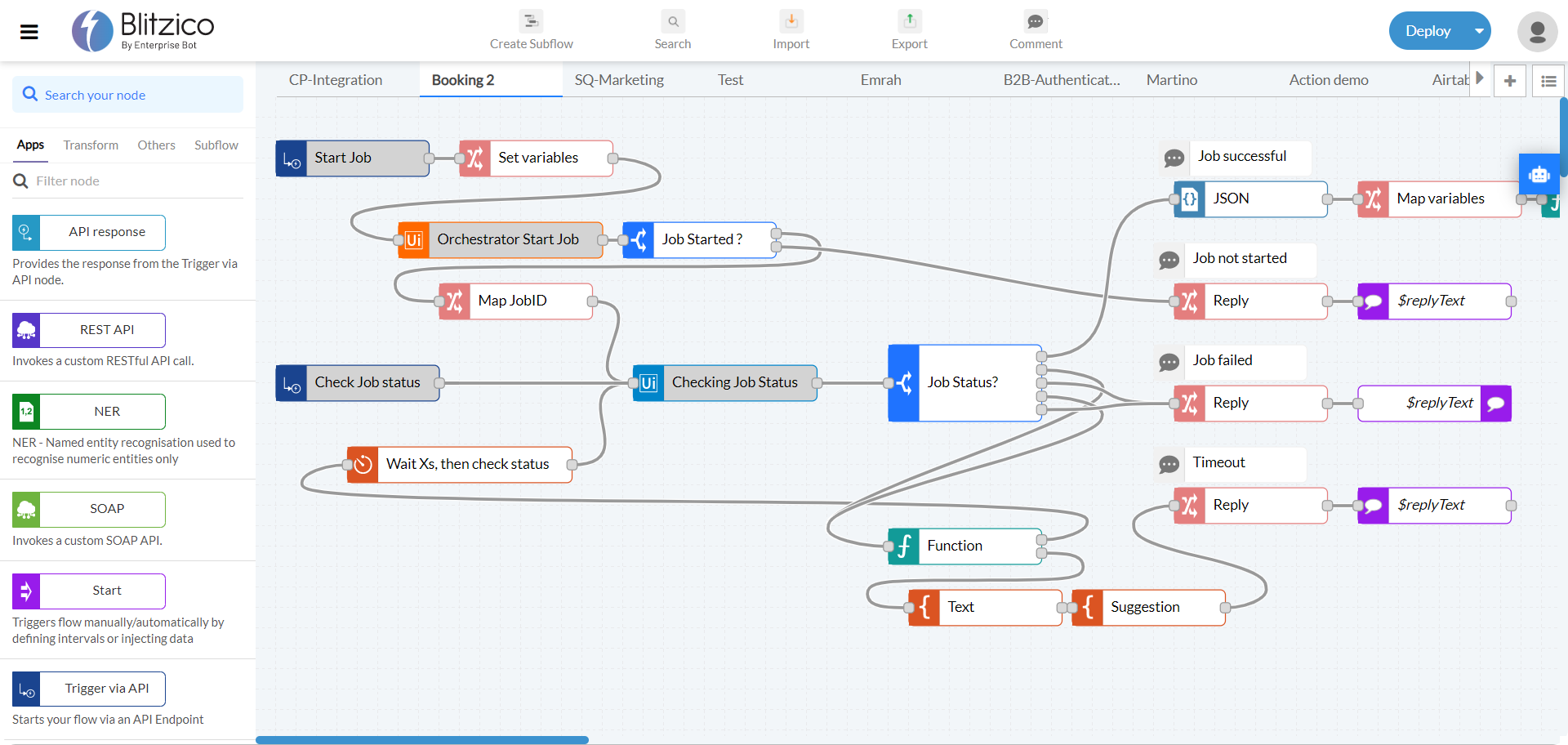

Integrate into core systems for claims or other workflows

Integrate into core systems for claims or other workflows

Enterprise Bot's omni-channel chatbots go beyond simple query responses. With our proprietary Blitzico middleware, complex workflows and connections with core systems can be built, allowing the chatbot to respond to queries AND take action to resolve issues. From providing information to initiating transactions, our chatbots offer a comprehensive solution for business needs.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

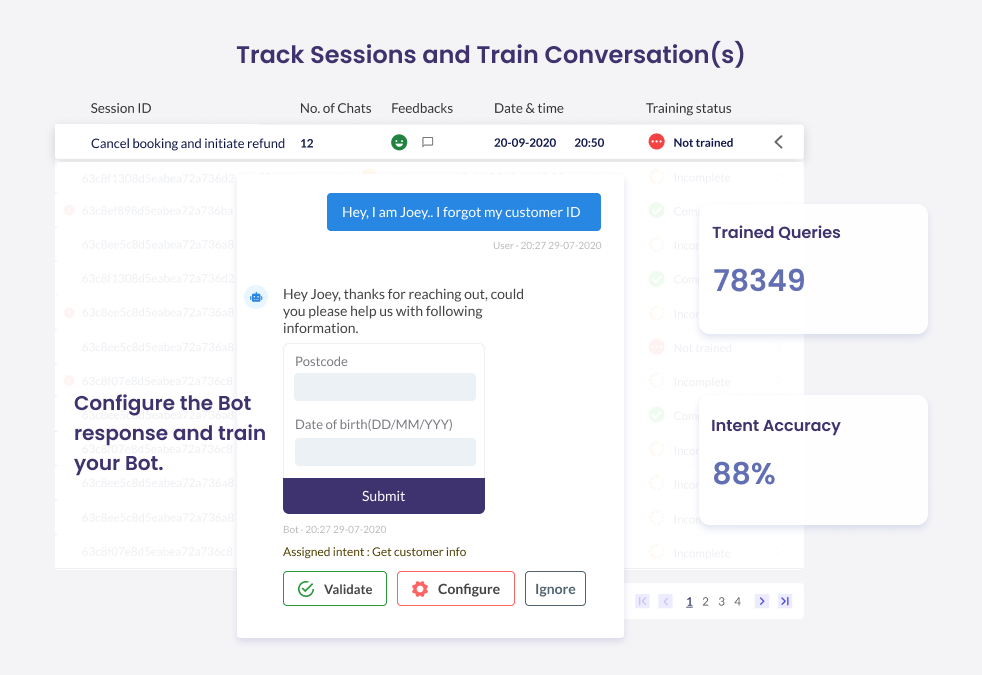

Deep Insights to help you improve your chatbot experience and automation

Deep Insights to help you improve your chatbot experience and automation

We offer in-depth reports to empower you with actionable insights, including conversation analytics, user behavior analysis, sentiment analysis, and performance metrics. With these data sets, you can monitor your chatbot's performance, identify areas for improvement, and optimize the user experience, all while harnessing the full potential of AI-powered automation. Additionally, our data can be connected to your preferred BI tool for comprehensive customer insights.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

What Our Client’s Say

"We wanted ChatGPT for our company - yesterday. But we quickly realized its limitations and it would have needed a lot of investment and resources to make it viable. That's when Enterprise Bot stepped in and gave us an easy enterprise-ready solution that we can trust. "

Pietro Carnevale

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

.png?width=2000&name=Group%201948757508%20(6).png)

Easily retrain the AI without any coding.

Easily retrain the AI without any coding.

Our platform offers a user-friendly interface that lets you retrain the AI without any coding skills. You can adjust the AI's behavior or update it with new data without needing a programming background. Our intuitive interface allows you to modify the AI's training data, fine-tune algorithms, and adjust behavior based on customer feedback and it feeds all this information also into your dashboards.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

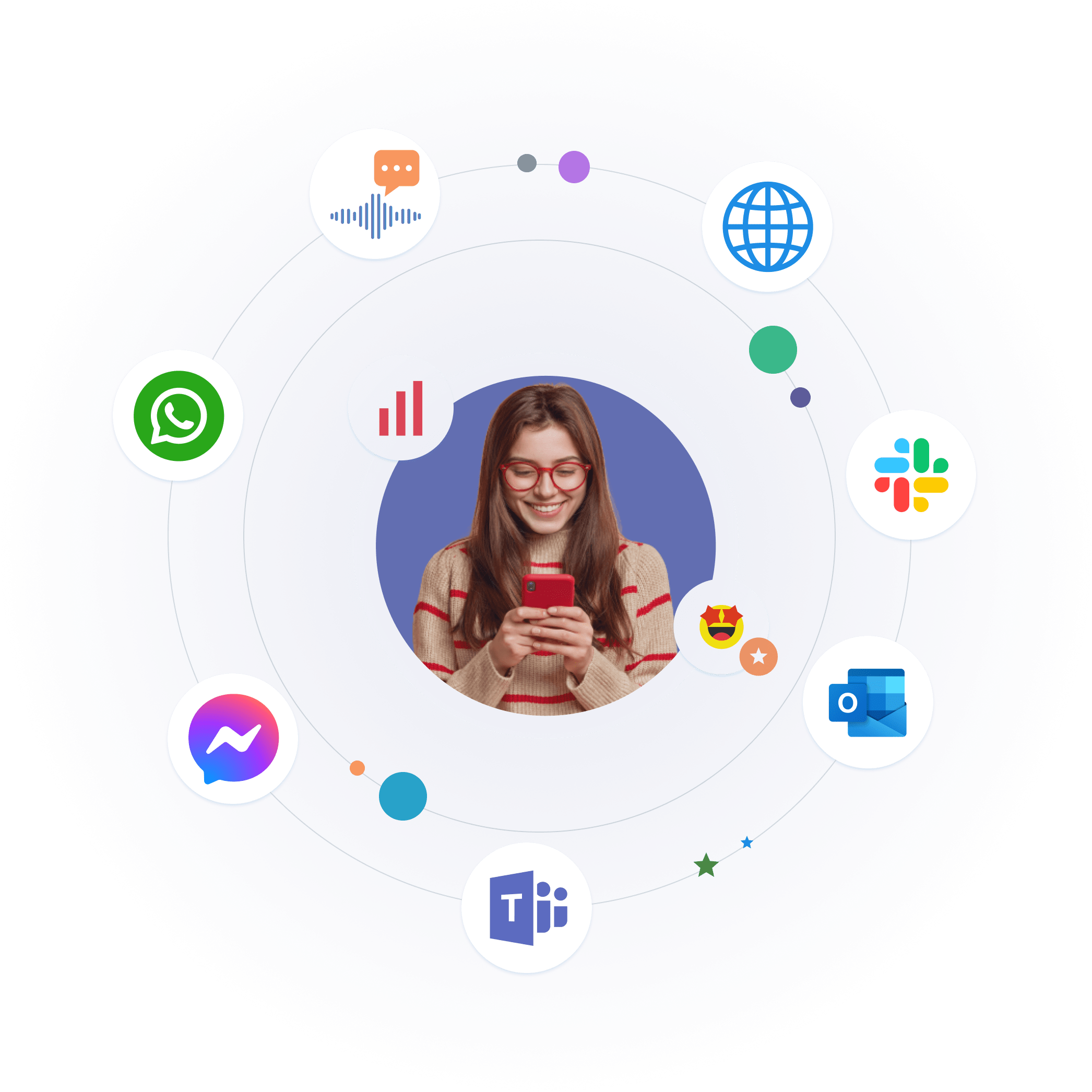

Single-brain, Omnichannel Solution with minimal effort

Single-brain, Omnichannel Solution with minimal effort

Our unique solution ensures a consistent and seamless customer experience across all communication channels. You can create your chatbot or voice bot once and deploy it across multiple channels, such as messaging, web chat, voice, and social media platforms, without rebuilding the bot for each channel. This approach reduces complexity and costs in developing and maintaining different bots for various channels.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Privacy, data security & hosting

Privacy, data security & hosting

Enterprise Bot tools prioritize privacy and data security. Communication is encrypted with AES 256-bit encryption in transmission and rest to keep your data secure. We have SOC2 certification and GDPR compliance, providing added reassurance that your data is secure and compliant. You can also choose between hosting on our cloud service or a complete on-premise solution for maximum data security.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

What Our Client’s Say

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Ready Integrations to virtually any of

your Existing System

-1.png)

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Successful Customers. Measurable Results.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

How Callpoint uses AI to improve the customer experience for teams & customers

A Swiss German AI voicebot for callpoint that automates customer interactions and ensures natural and smooth customer interactions.

30%

30%

Jose Taboas

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

.png)

How “Leonie” improves customer experience and operational efficiency at Generali Switzerland

Generali Switzerland chose Enterprise Bot and implemented Leonie , an AI-powered Swiss German voicebot.

97%

22%

Luis Bosshard

Director Customer Care Center Non-Life, Generali Schweiz

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

.png?width=560&height=836&name=Group%201948757508%20(4).png)

Maximum efficiency in record time.

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Trusted by leading global enterprises

.png?width=256&height=76&name=image%202%20(2).png)

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.

Book a free demo to see how Enterprise Bot + GenAI can transform your user experience

Heading 1

with a request body that specifies how to map the columns of your import file to the associated CRM properties in HubSpot.... In the request JSON, define the import file details, including mapping the spreadsheet's columns to HubSpot data. Your request JSON should include the following fields:... entry for each column.